Note: When computing the value of closing inventory, LIFO will consider the cost of the oldest inventory purchase, while FIFO uses the cost of the newest inventory purchase. Closing Inventory ValueĬalculation of Inventory Cost (Added to the Balance Sheet) We will calculate all the metrics using both the LIFO and FIFO method.

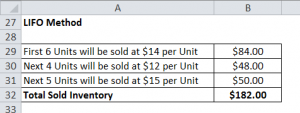

To determine the net income of Schmitt Retailers, we will first find the following: Previously produced units: 400 units ($15 per unit).Most recently produced units: 100 units ($20 per unit).We have the following financial data for Schmitt Retailers: Let’s consider Schmitt Retailers, which has a chain of electronic stores and uses the LIFO method for inventory valuation. To provide a comparison, we will also consider the results obtained using the FIFO (first in, first out) method. We will focus on how it affects the inventory value on the balance sheet and important financial metrics on the income statement, like COGS, gross profit, tax, and net income. In this case study, we will understand how the LIFO method impacts a company’s balance sheet and income statement. The total profit David made by selling 500 rubber stamps at $30 will be: Thus, David still has 350 units in his inventory, which is his closing inventory. We will add the remaining units from the previous table. The below table shows the value of the closing inventory. David sold 500 rubber stamps, so the closing inventory will include those still unsold. Therefore, the COGS, i.e., total money it takes the company to produce and sell 500 units, is $10,800.Īs we know, Mr. In this case, we will stop at 200 units (Date: 15-Feb) instead of the original inventory of 250 units. We will start with the most recent inventory and stop the calculation when we have sold 500 units. The table below illustrates how we can calculate the value of COGS. We need to determine the units sold from each inventory to calculate the cost of goods sold (COGS) for the 500 rubber stamps sold. Now, he needs to calculate the cost of goods sold for the remaining inventory on March 31, 2023.īelow is the detailed information about the purchase: Date David had sold approximately 500 rubber stamps for $30 each. David, who started a stationary retail store on February 1, 2023, and produced rubber stamps during the first two months (February and March). (Image Source: Walmart Annual Report 2023) Example of LIFO MethodĬonsider Mr.

As a result, the LIFO method affects current asset valuation, including the inventory component in the balance sheet.įor instance, Walmart uses the cost of its oldest inventory to find the value of its total closing inventories for the fiscal year. When using LIFO, we determine the closing inventory value on the balance sheet by considering the costs of older unsold inventory items. How LIFO impacts the inventory valuation on a Balance Sheet? (Image Source: Walmart Annual Report 2023)Ģ. Thus, it calculates the COGS or cost of sales using the cost of the newest inventory sold. Then the inventory value InvVal \text \cdot 100\% = 10\% Profit margin = 160 16 ⋅ 100% = 10%.For instance, Walmart uses LIFO for its inventory valuation.

0 kommentar(er)

0 kommentar(er)